Form 2106 or the Employee Business Expenses is actually a tax form that is distributed by the IRS (Internal Revenue Service). This form has been used by the general employees in order to reduce essential and ordinary expenses that are related to their jobs.

There is a difference between ordinary expenses and necessary expenses which is that ordinary expenses are normally considered as common expenses and only accepted in the specific types of business. However, the necessary or essential expenses are helpful in the conduction of businesses.

In this article, we are about to give you all the essential information you need to know about the Employee Business Expenses tax, this article also contains information like who can file this form and the process of filling this form, so continue reading.

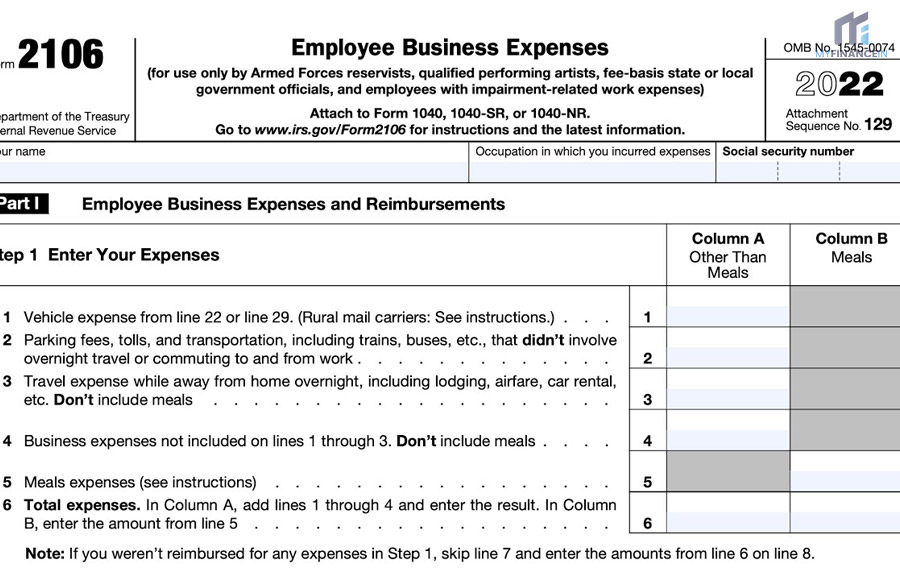

What Is Form 2106?

Image Source :- https://tinyurl.com/sfsn8yp7

After hearing the word form 2106 the first thing that comes to mind is that is ‘what is form 2106’. So in the introduction, we already have given you a brief about what is 2106 form and now we are about to get into some actual facts.

Starting in Tax Year 2018, most of taxpayers will no longer be capable of claiming unreimbursed business expenses in order to claim any type of deduction. As of this year, Form 2106 is only going to be available for Armed Forces Reservists, Fee-Based State, Qualified Performing Artists, Employees with Impairment-Related Work Expenses and Local Government Offenders, and.

Before 2018, any Employee with Unpaid Work Expenses could claim these Expenses as a Miscellaneous Itemized Deduction on IRS Form 2106. In the past, taxpayers had two choices when it came to claiming tax deductions for job-related expenditures.

They could either take the above-refund deduction or claim an individualized deduction for non-refunded job-related expenditures on their W-2 forms.

However, with the passage of Tax Reform in 2018, the former option was eliminated when the TCJA entered into force. In the past, there was a form that was used to claim a tax deduction for employee business expenses incurred in the course of their employment.

This form, referred to as Form 2106-EZ, was a simplified form used by employees to claim deductions for expenses incurred in connection with their jobs. However, this form was discontinued in 2018 due to the implementation of the TCJA.

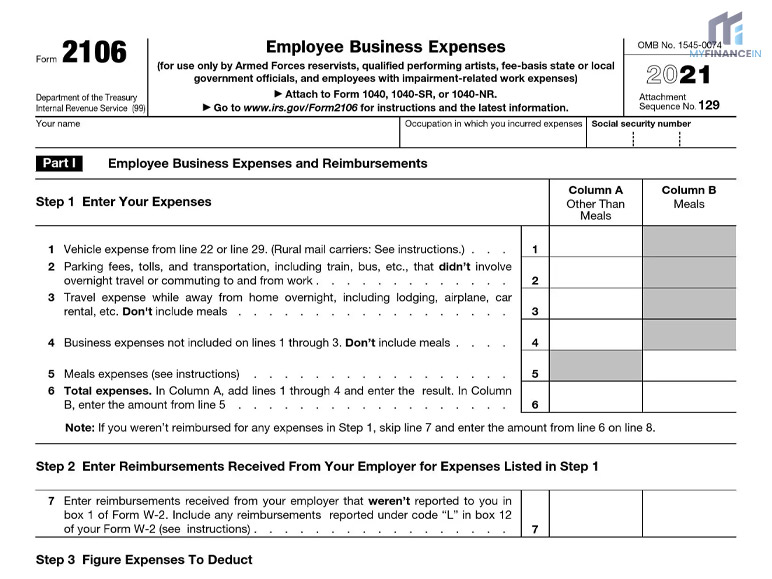

Who Can File The Form 2106?

Image Source :- https://tinyurl.com/ytb3e3ms

The Internal Revenue Service (IRS) has determined that Form 2106 can only be used by individuals who are:

- Reserve members of the armed forces

- Qualified performing artists

- State or local officials

- Fee-based basis Employees who have incurred work expenses related to impairment

- Before 2018, employees who had incurred work expenses that had not been reimbursed could claim those expenses on Form 2106 as miscellaneous itemised deductions.

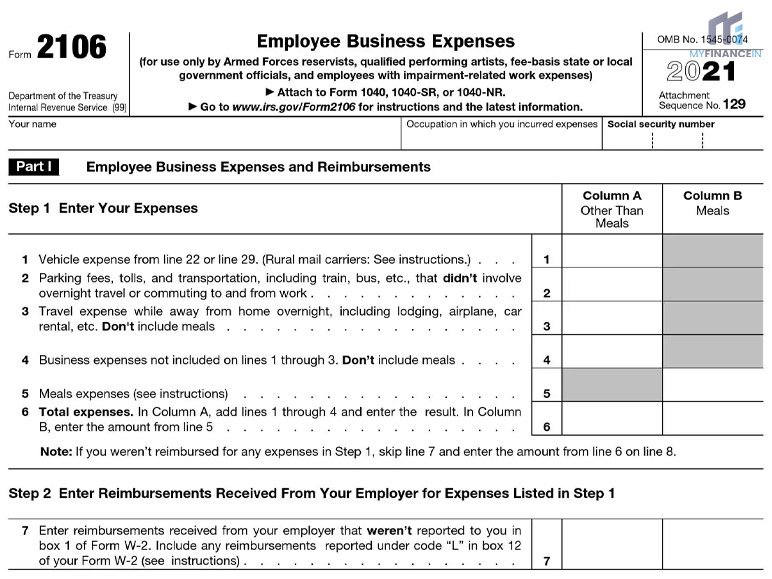

Steps To File Form 2106?

Image Source :- https://tinyurl.com/sfsn8yp7

In order to file form 2106 you need to do things in two parts and now we are going to provide you with information about how to file this form. These are the two parts of this process.

Part 1

When you fill out Form 2106, there are two sections. Part I shows you all the business expenses your employees have incurred and the reimbursements they got. It also tells you if you were able to get a tax deduction on those expenses.

This includes things like car rentals, parking fees, tolls, transportation costs, and any other business costs. You’ll also get any reimbursements from your employer.

Part 2

More specifically, vehicle expenses are addressed in Part 2. There are two options available to filers. The first option is considered to be the standard mileage rate. This rate is calculated by multiplying the IRS form 2106 tax year mileage rate by the number of miles driven for business-qualifying purposes.

The mileage rate takes into account gas and repair costs, as well as the average car’s wear and tear. For 2021, the standard mileage rate is 56 cents per mile, which is lower than the 57.5 cents per mile rate in 2020.

If you’re trying to figure out how much money you owe on your car, the second step is to figure out what you’re actually spending. That includes things like gas, oil, fixes, insurance, registering, and depreciation.

You can’t take out interest on car loans, and there are limits on how much you can get for your car. Even if you use standard mileage, you won’t be able to deduct those expenses. Plus, if you’re driving to and from work, those aren’t considered business expenses either.

How You Can Still Deduct Vehicle Expenses

Image Source :- https://tinyurl.com/bdfrefha

In Part II, it was necessary to calculate the amount of personal vehicle expenses that must be claimed under the standard mileage rate, which is calculated by multiplying the Internal Revenue Service (IRS) mileage rate for the fiscal year by the total number of business-eligible miles driven.

This rate takes into account the cost of gasoline and repair, as well as the average car’s wear and tear. The Internal Revenue Service (IRS) continues to provide self-employed taxpayers with the option to deduct the cost of operating a personal vehicle for the purpose of work-related activities.

The rate of deduction for the 2020 tax year was 57.5 cents per mile, and the rate for the 2021 tax year decreased to 56 cents per mile. Taxpayers are still able to deduct expenses associated with the utilization of their personal vehicles for charitable and medical purposes.

However, the deduction for the use of a personal vehicle to relocate for employment purposes is now limited to active military personnel only.

Conclusion

This article starts with a question that asks what is form 2106 and we tried our best to provide you information about this topic as possible in a way that is easy for you to understand this topic. Hope you find this article informative.

Have A Look :-