In today’s financial landscape, proof of income holds significant importance in various aspects of life, from securing loans to renting an apartment. One of the primary documents serving as proof of income is the . This article aims to delve into the role that paycheck stubs play in demonstrating income and why they are crucial in different scenarios.

Importance of Paycheck Stubs

Verification of Employment

Check stubs maker serve as tangible evidence of employment. They provide crucial details about an individual’s earnings, deductions, and taxes, thereby verifying their employment status with a particular organization.

Calculation of Income

Employers often require paycheck stubs to calculate an employee’s income accurately. These documents outline the salary, hourly wages, bonuses, commissions, or any other form of compensation received by the employee during a specific pay period.

Proof of Income for Various Purposes

Whether it’s applying for a loan, leasing a vehicle, or renting a property, proof of income is a prerequisite. Paycheck stubs offer concrete evidence of an individual’s earning capacity, making them indispensable in such situations.

Components of a Paycheck Stub

A typical real pay stub contains several essential components:

Basic Information

This includes the employee’s name, address, social security number, and the employer’s details.

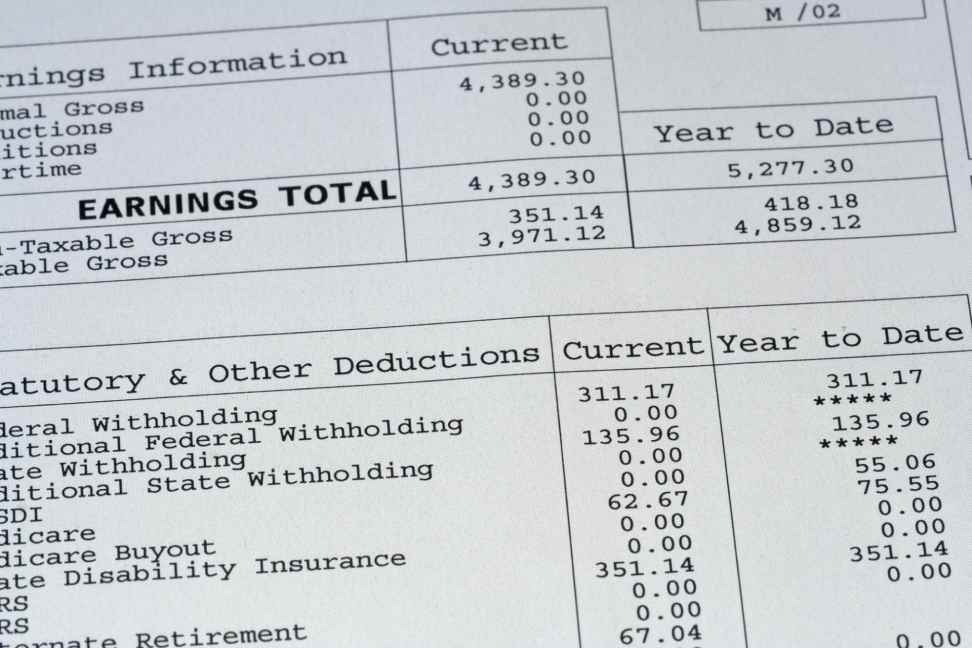

Earnings Details

It outlines the gross earnings for the pay period, along with any additional income like overtime pay or bonuses.

Deductions

Paycheck stubs detail various deductions, such as taxes, healthcare premiums, retirement contributions, and other withholdings.

Taxes

This section shows the taxes withheld from the employee’s pay, including federal, state, and local taxes.

How to Obtain Paycheck Stubs

There are several methods to obtain paycheck stubs:

Directly from Employers

Employees can request paycheck stubs directly from their employers, either in physical or digital format.

Through Payroll Services

Many companies use payroll services that provide employees access to their paycheck stubs online or through mobile apps.

Online Platforms

Several online platforms offer paystub generator free services, allowing individuals to create their stubs independently.

Uses of Paycheck Stubs

Applying for Loans or Mortgages

Financial institutions often require paycheck stubs as proof of income when individuals apply for loans or mortgages.

Renting a Property

Landlords may request paycheck stubs to assess a tenant’s financial stability before leasing a property.

Applying for Government Assistance Programs

Certain government assistance programs may require proof of income through paycheck stubs to determine eligibility.

Budgeting and Financial Planning

Individuals can use paycheck stubs to track their earnings, deductions, and expenses, facilitating better, Debt Consolidation budgeting and financial planning.

Legal Requirements and Regulations

Employers are obligated to provide accurate paycheck stubs to their employees, complying with federal and state labor laws.

Importance of Accuracy in Paycheck Stubs

Accurate paycheck stubs are crucial for both employees and employers to ensure transparency in financial transactions and tax compliance.

Ensuring the Security of Paycheck Stubs

It’s essential to safeguard paycheck stubs to prevent identity theft or unauthorized access to sensitive financial information.

Digitalization of Paycheck Stubs

With the advancement of technology, many organizations are transitioning to digital paycheck stubs for convenience and efficiency.

Challenges Faced with Paycheck Stubs

Despite their significance, paycheck stubs can pose challenges, such as errors, delays, or discrepancies, which may require prompt resolution.

Tips for Employees to Verify Paycheck Stubs

Employees should review their paycheck stubs regularly to ensure accuracy and report any discrepancies to their employers promptly.

Conclusion

In conclusion, paycheck stubs play a vital role in providing proof of income for various financial transactions and obligations. From verifying employment to applying for loans, these documents serve as a cornerstone in the financial landscape, emphasizing the importance of accuracy and security in their maintenance and utilization.

FAQs

Are paycheck stubs the only form of proof of income accepted by financial institutions?

While paycheck stubs are commonly used, other documents such as tax returns or bank statements may also serve as proof of income, depending on the situation.

Can paycheck stubs be altered or falsified?

Altering or falsifying paycheck stubs is illegal and can result in severe consequences, including legal action and termination of employment.

Do self-employed individuals need paycheck stubs?

Self-employed individuals may not have traditional paycheck stubs but can provide alternative documents like profit and loss statements or invoices to demonstrate income.

How long should employees retain their paycheck stubs?

It’s advisable for employees to retain paycheck stubs for at least one year for tax purposes and longer if needed for financial record-keeping.

Can paycheck stubs be used as proof of address?

While paycheck stubs contain address information, they are primarily used as proof of income rather than proof of address. Other documents like utility bills or lease agreements are typically accepted for proof of address.

Have A Look :-